ROI stands for Return on Investment rate. It illustrates the results of the company's investments - profitability or unprofitability. Investments mean both large investment projects and expenses for current needs.

Any investor wants to know what income he can count on when investing his funds in a particular enterprise. One of the most informative indicators that can answer this question is the ROI (Return on Investment) indicator - the rate of return on investment.

The ROI ratio is the rate of return on investment. Based on its calculation, an opinion is formed on the possible adoption or cancellation of a number of economic decisions:

In order to correctly interpret the results of calculations and make the right decision, it is necessary to understand the method of calculating the indicator. For calculations, the following data are used:

In order to obtain accurate results of values characterizing the return on investment, the data for calculation are taken comparable and not beyond the relevant range.

Calculations of the ROI coefficient can be different, depending on the area and situation, types of income and expenses. After all, ROI itself tends to show the approximate value of return on investment, but since there are many areas and types of investments, there can be no single formula.

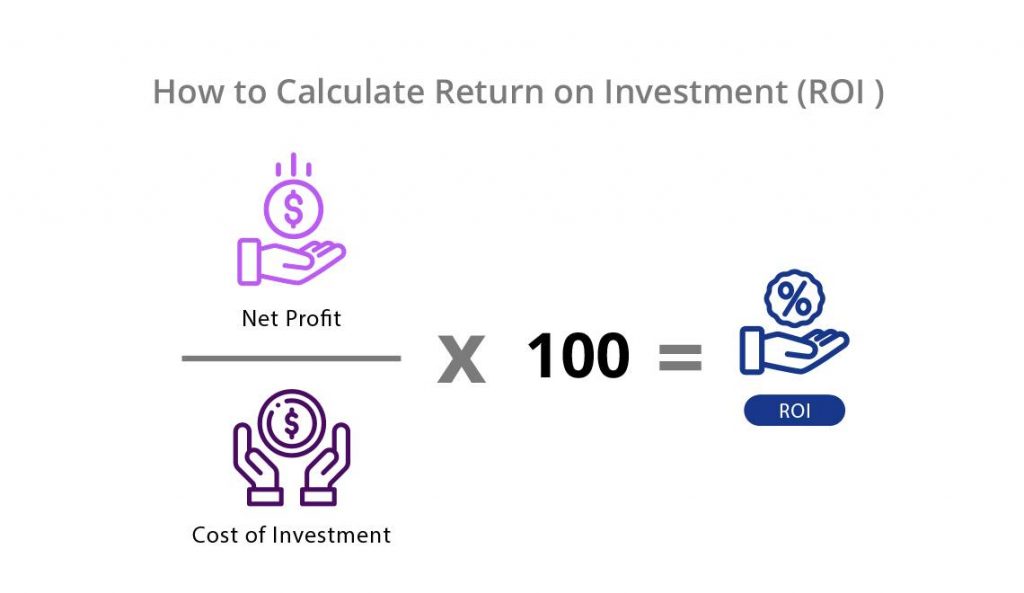

There are several options for formulas that allow you to calculate the ROI. Main (basic) formula:

ROI = (revenue - costs) / investment volume * 100%

This method is used by investors when evaluating the effectiveness of investments and marketing specialists of the organization to justify the effectiveness of marketing activities. The coefficient calculation format is percentage. There is no exact standard value of return on investment.

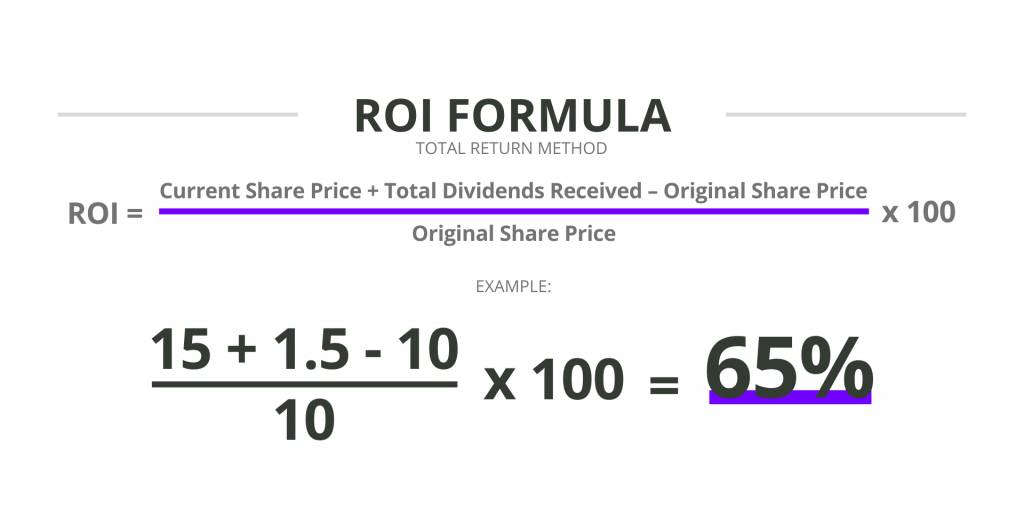

To assess the profitability of investments in financial assets (stocks, bonds), the following formula is used:

ROI = (return on investment - volume of investments) / volume of investments * 100%

This calculation option is often used by investors conducting operations in the stock market. The results are interpreted in the same way as in the base case.

To calculate the return on investment, taking into account the length of the period, asset ownership, the following formula is applied:

ROI = (revenue - costs) * duration of the period / amount of investment * 100%

The method allows you to calculate the value of return on investment if the asset was owned by the investor for an incomplete period (year, month - depending on the choice of range) more correctly.

Calculations using these formulas can be carried out both for the asset as a whole (organization, portfolio of investments in securities), and for each specific transaction.

Constant monitoring of the values of this indicator is necessary for both investors and business owners.

Investors use it to determine the profitability of investments in various types of assets and the feasibility of further participation in projects. Business owners get the opportunity to assess the investment attractiveness of their business from the point of view of potential investors and the effectiveness of management actions.

Methods for calculating the return on investment ratio can be applied in the analysis of various aspects of the organization's activities:

The calculation of the return on investment ratio is made for the purposes of the forecast and based on the actual data obtained. This allows you to analyze the reasons for the deviation of the actual value from the planned one and develop an action plan to optimize the situation.

In each case, the rate of return on investment must be considered separately. Just a big number means nothing. It may happen that you get a high result for an inefficient business. Conversely, a promising start-up will show low values.

In general, it is undesirable for ROI to be below 100%. A negative ROI can be both a signal to urgently reduce costs and indicate that you need to continue investing in a project.

It should be said right away that there is no unequivocal opinion about ROI among marketers. Supporters of the investment count argue that the indicator is important for determining the strategy - it makes it possible to evaluate the benefits of investments. Opponents appeal to the fact that this indicator is subjective. Most often this is due to the fact that the person counting the indicator is trying to highlight his utility, and due to the flexible form of calculating the indicator, this can be easily done.

We consider ourselves to be supporters of ROI, and we consider this indicator useful and important.

The indicator is considered by investors, but it is also useful for marketers. Among specialists, you can often find the name ROMI (Return on Marketing Investment). The calculation formulas are identical.

What is P R bond?

27/11/2023

What is P R bond?

27/11/2023

What is Compulsory Convertible Debentures?

27/11/2023

What is Compulsory Convertible Debentures?

27/11/2023

Dynamics of Central Asian Economies

17/11/2023

Dynamics of Central Asian Economies

17/11/2023