In finance, ROE stands for return on equity. This ratio shows how much net income equity can generate. Expressed as a percentage.

Return on equity (ROE) is understood as an indicator of the ratio of an organization's net profit to the average annual value of equity capital.

In simple words, the ROE ratio is the annual profit of the company, after deducting all taxes, fees and other obligatory expenses, divided by the value of all the founders' funds invested in the company without borrowed funds.

To understand how to calculate the return on equity, here are a few formulas:

ROE (return on equity) = profit (net income) / equity (equity)

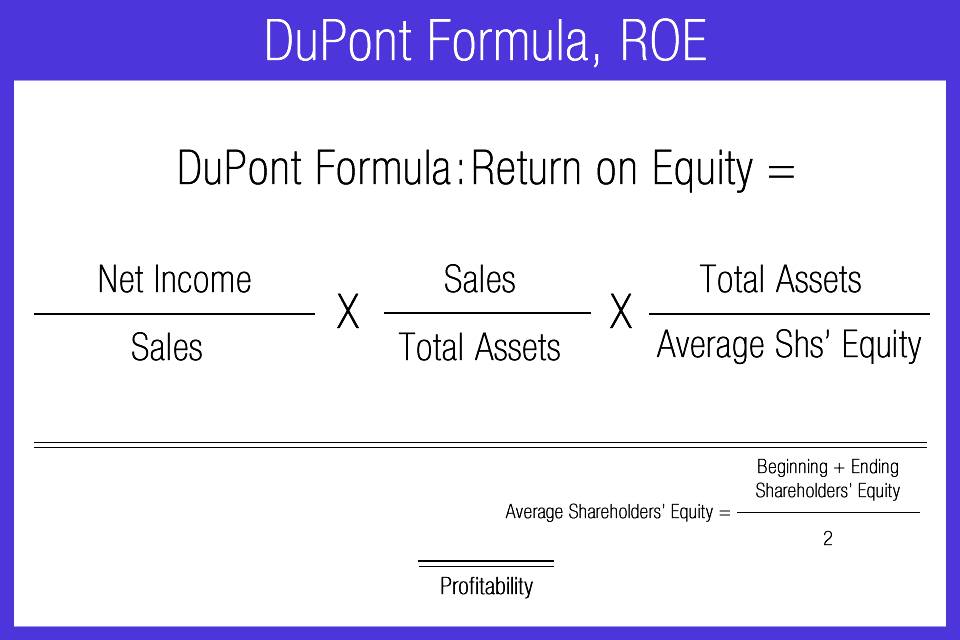

For a more thorough analysis of indicators affecting the return on equity, you can decompose the above formula into a three-factor DuPont model:

ROE = Net Income/Equity = (Net Income/Revenue) x (Revenue/Assets) x (Assets/Equity) = ROS x TAT x TL

This formula makes it possible to explore in more detail the factors affecting the profitability of the enterprise, to identify the strengths and weaknesses of the business.

The data for calculating this coefficient is easiest to find in the financial statements of the enterprise under study.

Very often, for convenience, the fractional value of the ROE coefficient is multiplied by 100, thus representing the value as a percentage.

The ratio of the net profit of the enterprise to the amount of equity capital gives information to the investor about the possible profitability of the "percentage of return" of funds invested in securities and other investment instruments.

In other words, if a bank offers to open a deposit to a client at 10% per annum, then the company's annual ROE equal to 10% will also indicate that the investor who bought the company's shares received a profit of 10% per annum on the invested funds.

However, it is worth noting that with ROE equal to the annual bank rate, investing in a deposit will be more reliable. At the same time, as a rule, the return on equity ratio of a successful company is always slightly higher than bank rates, which encourages both traders and banks themselves to invest in stocks, bonds and derivative financial instruments.

Using the ROE ratio, it is not necessary to compare the return on stocks with the performance of bonds or bank deposits. Basically, ROE is a financial indicator used to compare the profitability of enterprises in various industries (search for a highly profitable industry), or to compare the efficiency of companies operating within the same industrial sector (metallurgy, energy, engineering, etc.).

There are various methods for evaluating a stock's earnings outlook using ROE.

One sector of the economy can be represented by several or even dozens of enterprises. In such conditions, an understanding of the average profitability is formed, which can be counted on by purchasing shares of the corresponding enterprise. This value will reflect the average ROE of enterprises by industry.

By comparing the industry average return on equity ratio with similar indicators of enterprises, it is possible to determine which of them will give more profit to the investor.

There are several ways to interpret the return on equity ratio. Obviously, in an ideal situation, the higher the ROE value, the more efficient, the better the enterprise. Professional investors and private entrepreneurs must present the profitability of their investments. You can invest both in your own business and in alternative assets, in a certain case, even a bank deposit can be an investment object.

In fact, if the securities of a third-party company are more profitable than their own business, then it is profitable for the owner to invest in them.

An excellent ROE ratio is 2 times the rate on bank deposits. At the same time, ROE with a slightly higher percentage of deposits is losing its attractiveness. By purchasing shares, the investor takes on additional market risks, which the deposit is deprived of.

Several conclusions can be drawn from the above:

What is P R bond?

27/11/2023

What is P R bond?

27/11/2023

What is Compulsory Convertible Debentures?

27/11/2023

What is Compulsory Convertible Debentures?

27/11/2023

Dynamics of Central Asian Economies

17/11/2023

Dynamics of Central Asian Economies

17/11/2023